Daniel Kahneman, in his book Thinking, Fast and Slow, recommends us to anchor our predictions on a plausible base rate. Here is a collection of the "base rates" on the venture capital markets.

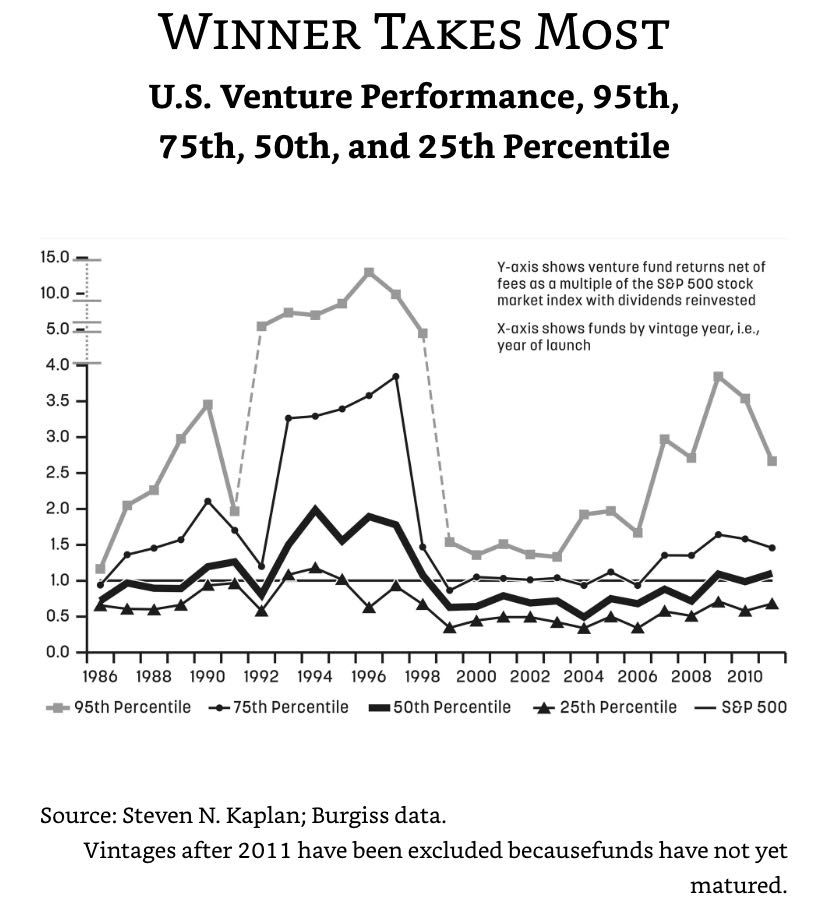

S&P500's performance outruns p50 VCs from 2020 to 2010. And we need to be better than p75 to outrun S&P500. Winner takes most.

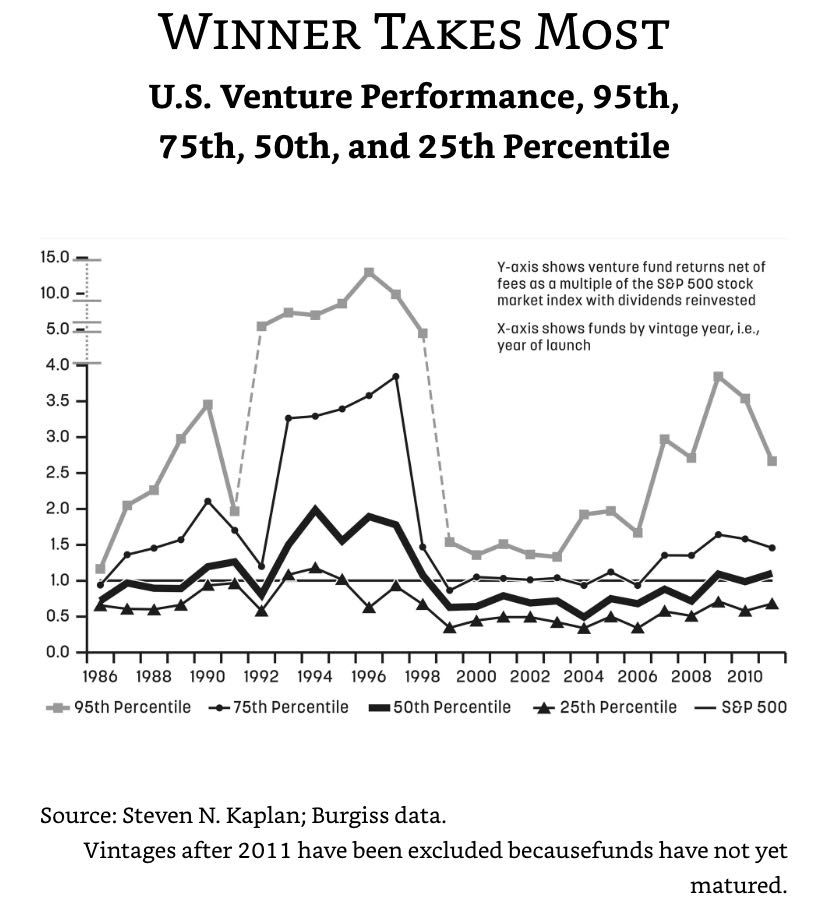

VC winners win bigger. (source)

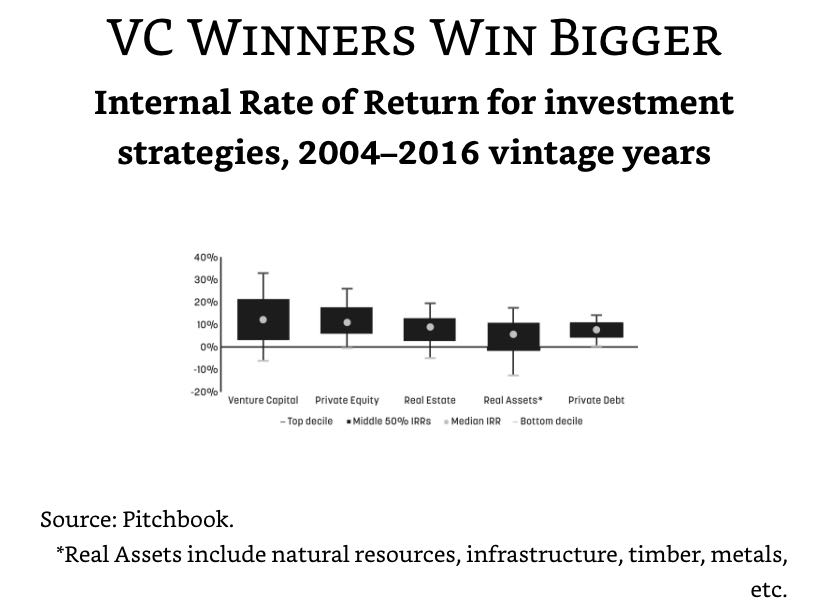

While acquisitions account for the highest number of VC deal exits (65% in 2021), public listings account for 90% of the total exit value. (source)

at what point in the fundraising journey are most startups acquired?

A paradigm shift is a fundamental change in the way that people think about or approach a particular problem or concept. In the context of making investment decisions, a paradigm shift could be an important factor to consider because it can affect the long-term viability of an investment.

For example, a paradigm shift in technology or consumer behavior could lead to the emergence of new products or markets that render existing investments obsolete. In this case, investors who are aware of the potential for a paradigm shift may be better able to identify and adapt to these changes, potentially avoiding significant losses.

1920s = “Roaring”: From Boom to Bursting Bubble